Asia is poised to become the frontrunner in the global caustic soda capacity additions by 2030 due to the increasing demand from vital industries, including chemical manufacturing, water treatment, petroleum refining, textiles, and cleaning products. The burgeoning petrochemicals, textiles, and alumina sectors in the region, which are heavily dependent on caustic soda, are expected to be the primary drivers of this demand.

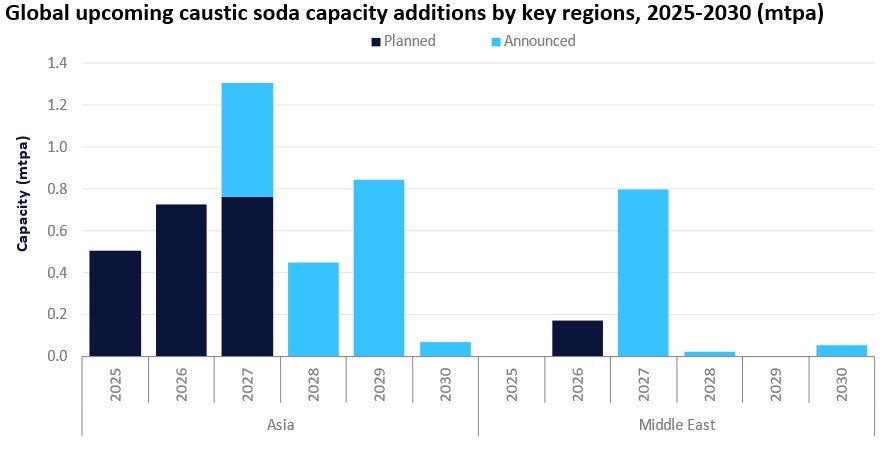

Asia is expected to add a caustic soda production capacity of 3.89 million tonnes per annum (mtpa) from eight planned and ten announced projects. The majority of these capacity additions are from upcoming projects in China and India. By 2030, the capacity addition in China is expected to be around 1.65mtpa from six upcoming projects while seven projects are expected to add a capacity of 1.33mtpa in India.

The highest capacity addition in the region is from the ‘Mundra Petrochem Mundra Caustic Soda Plant’, a planned project located in Gujarat, India. It is expected to commence operations next year with a capacity of 0.73mtpa. Mundra Petrochem is the operator while Adani Enterprises holds most of the equity stake in the plant.

The ‘PT Chandra Asri Perkasa Cilegon Caustic Soda Plant’ in Indonesia, as well as the ‘Chongqing Jialihe New Materials Technology Changshou Caustic Soda Plant’ and the ‘Jizhong Energy Group Huining Chemical Xingtai Caustic Soda Plant’, both in China, represent other significant capacity additions in the region during the outlook period.

Other than Asia, the Middle East is the other key region that is anticipated to witness considerable caustic soda capacity additions of 1.04mtpa by 2030. The major capacity addition in the region is expected from the ‘Taziz EDC and PVC Ruwais Caustic Soda Plant’ in Abu Dhabi, United Arab Emirates. It is expected to commence production in 2027 with a capacity of 0.80mtpa.

The remaining capacity addition in the region is from the ‘Ghadir Petrochemical Company Bandar Imam Caustic Soda Plant’ in Iran and the ‘State Company For Petrochemical Industries Basra Caustic Soda Plant 2’ in Iraq. They are scheduled to come online in 2026 and 2030 with capacities of 0.17mtpa and 0.05mtpa, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFurther details of global caustic soda capacity and capital expenditure analysis can be found in leading data and analytics company GlobalData’s new report: Caustic Soda Industry Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants to 2030.